Published on

Protecting Peace with Receipts

Written by Michelle Brown

Five minutes now vs five hours later.

Picture it: you’re chatting away, in the zone, chatting excitedly about business. You and your colleague are moving mountains with this conversation. You’re barely paying attention when the server drops the check, and perhaps even less when you stuff your copy of the receipt into your wallet.

Should you stop, write the proper info upon receipt, take a picture of it to send to your bookkeeper, and then carefully file away the paper copy in a physical monthly file, as well as a digital file? Ain’t nobody got time for that. That’s a problem for “future you.” How long will it take later?

I regret to inform even those with a photographic memory, the answer to “how long will it take?’ is exponentially longer than how long it will take you right now to follow the steps one must always follow to account for expenses.

And since expenses are kryptonite to Uncle Sam’s tax calculator, expenses are very, very important. The more you can account for, the less your tax burden. Full stop.

receipts touched 1X > receipts touched 3X

If that isn’t enough of a reason to put a near-religious practice of managing your receipts, let’s put the fear of God into the mix—or in this case, the IRS.

For you see, the IRS requires that legitimate business expenses come with receipts, literally. For S-E-V-E-N years.

In the name of risk management, being audit-proof, and all things holy, please do not let “future you” suffer the pain, loss, and anxiety of an IRS audit.

Audits require physical proof. Not bank statements. Receipts.

Stop spending time, resources, and money (what’s your CPAs hourly rate again?) for something that takes five minutes. Besides avoiding hours scratching your head wondering why you spent $75 at Dunkin, or avoiding the Abominable Auditman, there is a pot of gold at the end of this task-rainbow: your bookkeeping accuracy will be…chef’s kiss. 👩🍳🤌 💋

The five minutes you are saving not breaking the flow of conversation with a colleague, or precious time at Office Depot buying emergency flip-charts for tomorrow’s presentation, or paying for the UBER on the way there, they are not worth the oodles of hours and dollars it will cost you to recover the value of a lost, faded, and uncategorized receipt.

Because process is power.

The most successful business baddies I know intentionally follow best practices and processes. They get steady—and stay audit ready. They decide on roles and rules with purpose and follow them to the letter. They understand the difference between meals out to feed yourself, feed a team meeting, and courting a client. In other words, they know the cost of not doing it right.

In my experience, the difference between those embracing albeit tedious processes in receipt management and those who see making a habit out of proper receipt wrangling more as a pipe dream straight out of Willy Wonka’s Chocolate Factory…it all boils down to whether or not you have a system.

If you’re in the latter camp, I see you, friend.

Right now, here’s a chance to start a new habit and stop telling “future you” that you’re gonna risk it for the biscuit. (While we’re big fans of dog biscuits around here, they are not worth risking tomorrow’s tranquility.)

Zelda P Moneysworth presents: Receipt Management with Footing & Fortitude (or, how to protect your peace in 5 minutes or less, even if you don’t know the first thing about bookkeeping).

🐾 STEP 1 | Note the following information:

1) What is it for? (e.g., team meeting, client lunch, travel)

2) Who is it for? (e.g., prospect, partner, yourself)\

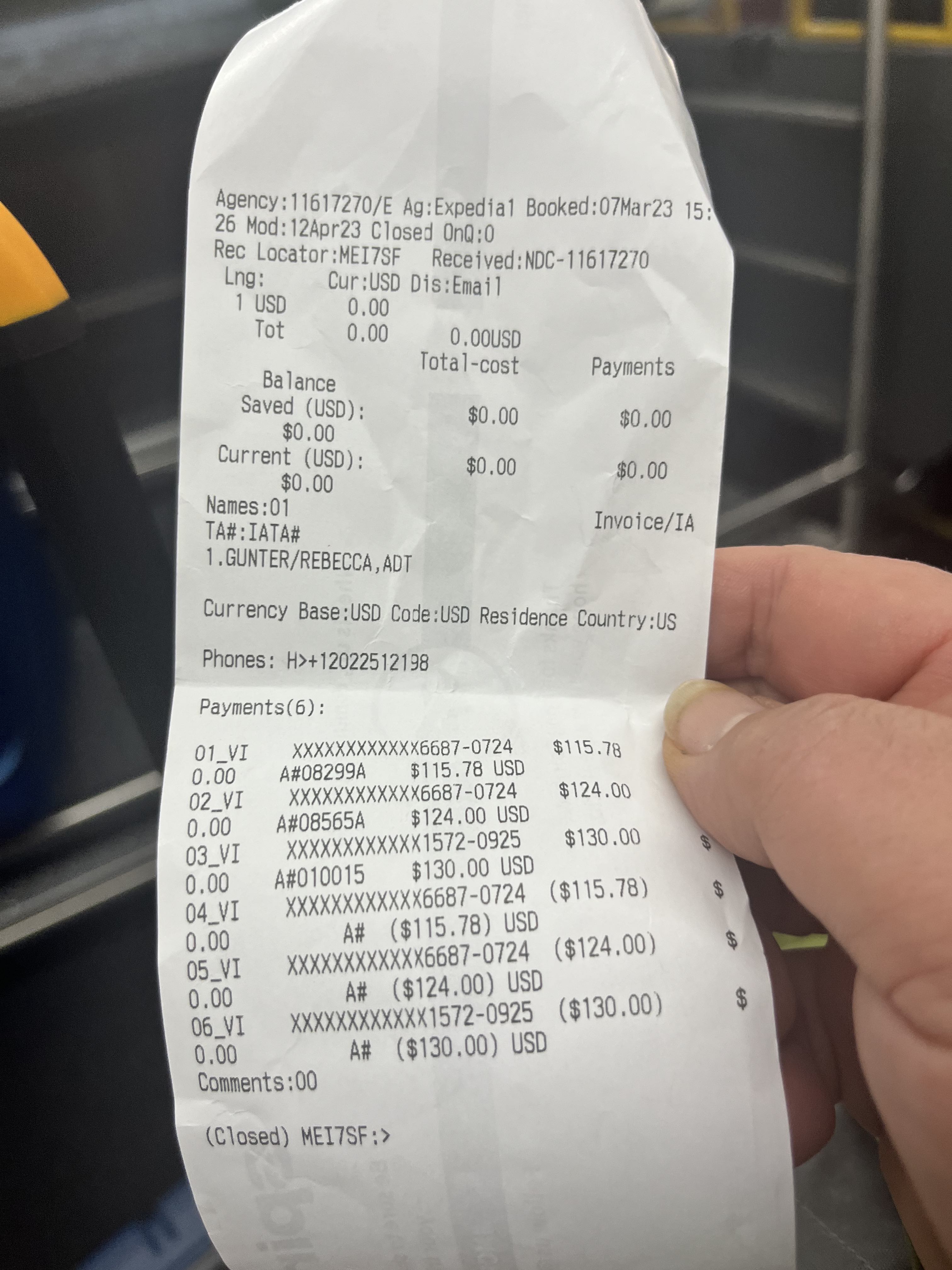

🐶 STEP 2 | Take a picture, screenshot, or PDF of the receipt.\

**🦮 STEP 3 | Put it in a folder. **

Paper in paper, digital in a cloud-based folder shared with your bookkeeper or friendly, neighborhood financial systems strategist, at your service)\

🦴 STEP 4 | Bask in the satisfaction of adopting a system and being a champion for peace of

mind and “future you.”

![]()

Miscategorized expenses, missed opportunities, and money left on the table make us sad. Let’s not do that, when in just five minutes or less, you can inspire your accountant—and your bottom line—with your nose for business and dogged commitment to the system.

**Are receipts the bane of your existence? If you need help making an alliance with the process and being accountable to the system, reach out **to michelle@unleashedfinancialadvocates.com; inspiring untethered adaptability and taking agency over peace of mind is what we do.